FAQ

Does it cost me anything to apply?

No! There is no cost to fill out our online car loan application. There is no risk or cost to you.

Does applying impact my credit?

When you apply for any loan it does affect your credit rating. Some companies will send your application to all of the banks “hoping” one will approve you. This means your credit is pulled 5-10 times which is not good! (Lowers your Credit score by 5 points every time). After carefully reviewing your information, we contact you, find out the details of what has happened in the past so as to submit you to a auto finance lender that will approve you!

What happens to my information?

Immediately after you fill out your car loan application, we receive an email informing us you have done so. We review your application carefully and present it to the auto finance lender whom is most likely to extend you credit in your situation. At that time we will be contacting you and discussing all options.

Your Information is 100% Private!

We do not share your personal information with anybody! We are not in the business of selling or sharing your personal information with any other firm or entity.Other lenders have turned me down before.

If you have been turned down before do not despair. We have approved customers which were turned down by other dealerships. We have lenders that can deal with any situation. We cannot guarantee terms and conditions but we will explain what you need to do to get approved. In every case, we will guide you and explain what you need to get approved, our approval rate is higher than 99%.

How much do I qualify for?

Once you send in your auto credit application we can determine what amount you can qualify for.

How much of a down payment will I need?

That depends on what you would like your down payment to be. The more money down the less your payment will be.

Can I use my trade for a down payment?

Yes.

What type of vehicle can I purchase?

That depends on what amount the financial institution approves you for. But rest assured we have plenty of used cars on our Winnipeg lot that can fit your needs and your budget.

What and who determines my auto loan interest rate?

Interest rates are set according to the current condition of your credit. Banks use a credit rating score to determine APR to be set for your auto loan. The credit rating score is normally referred to as FICO or Beacon score. Prime borrowing is usually a score above “660-710?, and interest rates for a prime customer are generally lower. A score between “300 and 659? is considered “special finance” or “sub-prime”. Sub-prime lending rates are usually a bit higher depending on your score and present personal circumstances such as owning a home and time at current position.

Can I put zero down?

Your present credit situation will determine the need for a down payment. The general rule is Prime buyers with good credit qualify for zero down financing. Sub-prime buyers in Manitoba or Canada generally should have at least $500-$1000 or 5%-10% down depending on Clients previous Credit History and yes, trade-ins count as a down payment. It is always wise to be prepared to have a down payment and then be pleasantly surprised when one is not required.

What do I need to apply?

You must be at least 18 years old. Have a valid Drivers License or a co-signor with one.

Gross monthly income of $1800 per month (Minimum) and at least 3 months on the job to qualify for a car loan, there is one exception with being only with 1 month on the job but with higher income.How far do your services travel?

Although our head office is based in Winnipeg, Manitoba, our finance department services the entire Manitoba regions of Brandon, Steinbach, Lockport, Winnipeg Beach, Portage La Prarie, Winkler, Altona, Morden, Killarney, Virden, Russel, Thompson, Dauphin, Grandview, Arborg, Neepawa, Dugald, as we are able to deliver vehicles across Eastern and Western Canada. We have car loan clients from Calgary, Edmonton, Red Deer, Lethbridge, Fort McMurrey, Saskatoon, Regina, Kenora, Dryden, Thunder Bay and other rural areas with used car financing.

What's the minimum monthly income required to be approved for a car loan?

We recommend at least $1,800 per month income or have a co-signer that qualifies. This will allow our staff to get you pre-approved within 24 hours for a new or used vehicle.

Get in Touch

We're here 6 days a week to answer any questions you have!

Call us at 1-204-888-4070 and book your self a test drive or visit us at 302 Archibald Street, Winnipeg, MB!

See Details

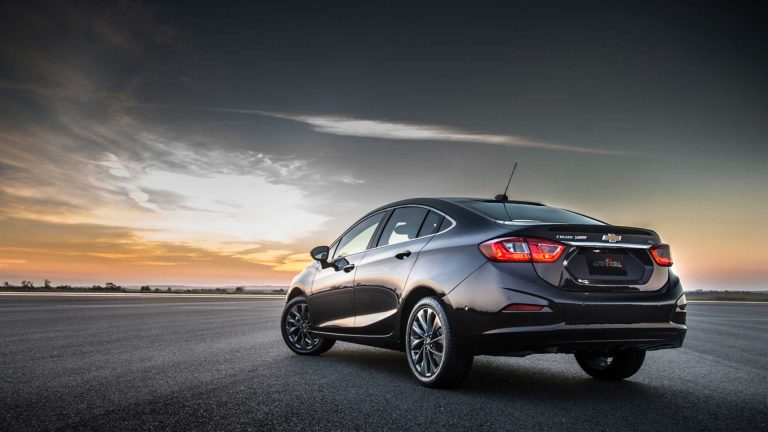

2018 Chevrolet Cruze LT

HEATED SEATS – SUNROOF – BACK-UP CAMERACall Today

2021 Ford Bronco Sport Outer Banks

HEATED SEATS – BACK-UP CAMERA – BLIND SPOT MONITOR

2020 Nissan Qashqai SV

SUNROOF – BACK-UP CAMERA – HEATED SEATS

2019 Nissan Pathfinder SV

NAVIGATION SYSTEM – 3RD ROW SEATING – HEATED SEATS